will child tax credit payments continue in january 2022

1247 AM CST January 1 2022 Updated. Those returns would have information like income filing status and how many children are.

Opinion The Child Tax Credit Has One Last Chance For Expansion In 2022 South Seattle Emerald

The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

. Licensed Child Care As of March 28 2022 Ontario signed onto the Canada-Wide Early Learning and Child Care CWELCC Agreement which aims to reduce child care. 123 AM CST January 1 2022. 28 to ensure payments continue in January 2022.

To receive 2022 child tax credit payments families must wait until next years tax season. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. Will the monthly child tax credit payments continue in 2022.

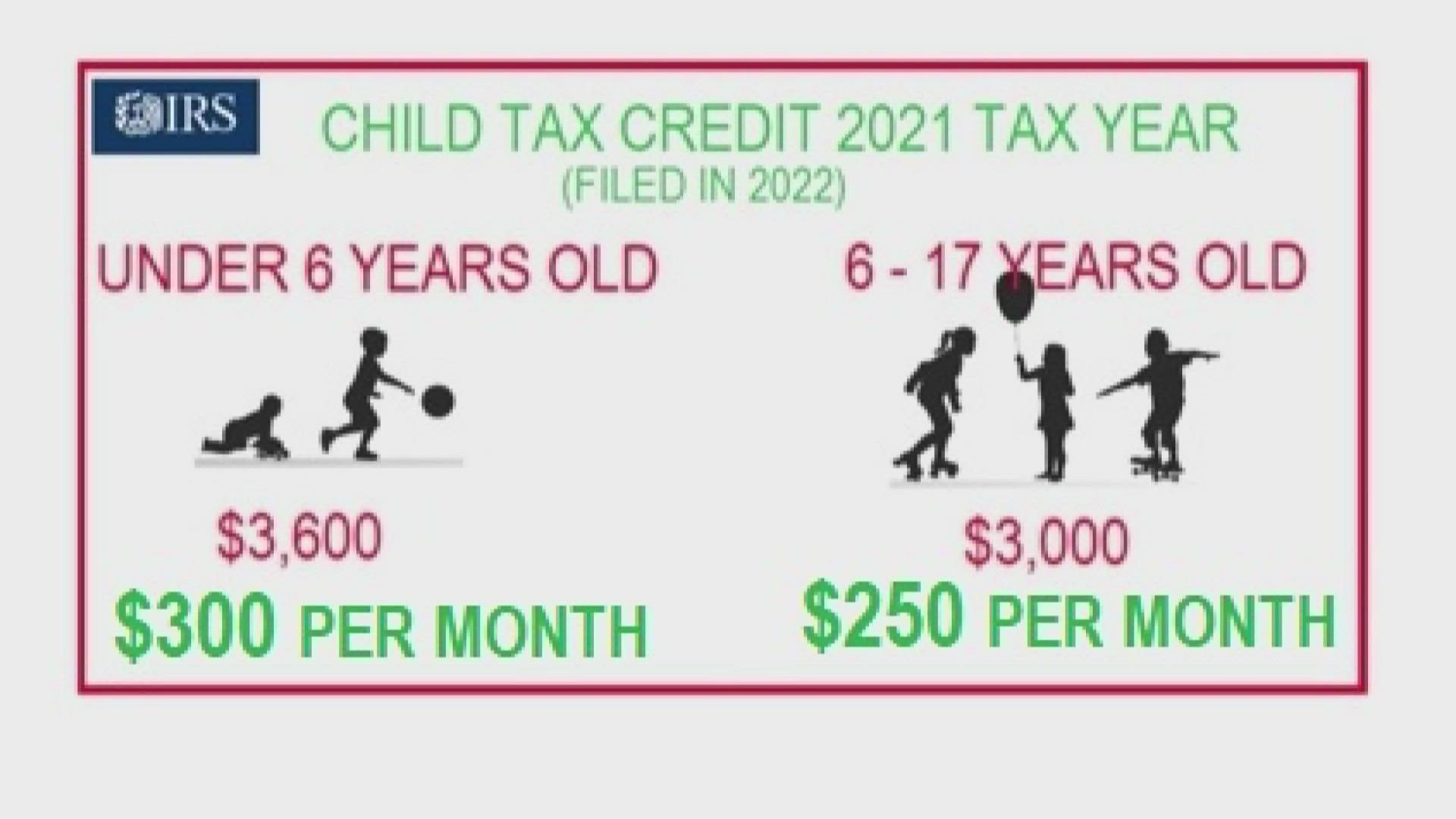

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17.

You can qualify for the full 2000 child tax credit if. Is there going to be a child tax credit in 2022. The Internal Revenue Service.

Those returns would have information like income filing status and how many children are. In fact Congress would need to approve an extension of the CTC with or without the full BBB bill passing by Dec. This year the Child Tax Credit will revert back to the program offered by the IRS before the American Rescue Plan expanded it in 2021.

The benefit for the 2021 year is 3000 and 3600 for children under. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The advance child tax credit payments were based on 2019 or 2020 tax returns on file.

Tag Child Tax Credit Nbc Connecticut

How The Child Tax Credit Originated And The Future Of The Child Tax Credit Forbes Advisor

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 No Direct Monthly Payments In January Mcclatchy Washington Bureau

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

Stimulus Check Update These Families Will Get 3 600 In 2022 Wbff

Child Tax Credit 2022 Update Americans Can Get Direct Payments Up To 750 But Deadline To Apply Is Just Weeks Away The Us Sun

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

Future Child Tax Credit Payments Could Come With Work Requirements

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Stimulus Update There May Still Be Hope For Monthly Child Tax Credit Payments In 2022 Here S Why

Stimulus Update Irs Has New Guidance To Claim Payments In 2022 Al Com

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Nc Parents Won T Get Monthly Child Tax Credit Payment Jan 15 Raleigh News Observer

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Millions Of Families Received Irs Letters About The Child Tax Credit